With the current cost of homeowners insurance, property taxes, and even groceries, you might wonder if we can expect to see the number of foreclosures increase in 2025. As a real estate agent who’s passionate about our beautiful Okaloosa County, I wanted to share some insights into the housing market trends for 2025. Whether you’re a first-time homebuyer, a seasoned investor, or just keeping an eye on your property’s value, here’s what’s happening in our area.

Okaloosa County at a Glance

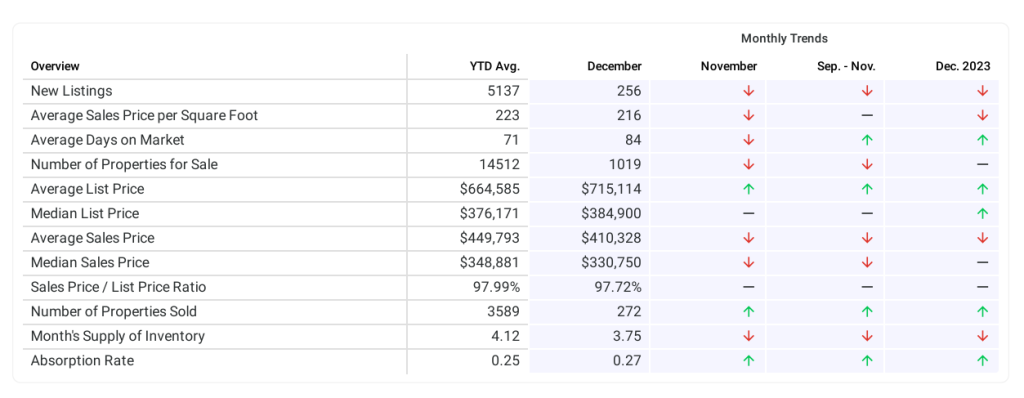

The county’s housing market is leaning towards a buyer’s market this year. That means there are more homes available than buyers—a silver lining for those in the market for a new place to call home. The median home price in Okaloosa is hovering around $359,158, showing a slight decrease compared to last year. According to the latest March 2025 home sales report, the median sold price in Okaloosa County was $359,158, with a median price per square foot of $211. This represents a 0.2% decrease compared to March 2024.

Foreclosures are present but not overwhelming, with a total of 478 properties in distress. While primary residences are more vulnerable due to financial challenges like rising mortgage rates and insurance premiums, secondary homes—like vacation properties—are faring better thanks to their owners’ financial stability.

Spotlight on Key Cities

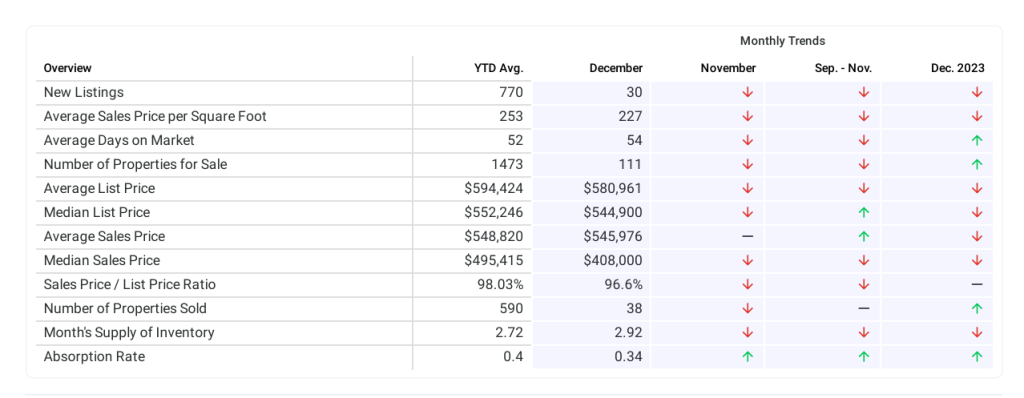

Niceville

Niceville remains a gem in our county, with a balanced market and approximately 151 foreclosures available. The median sales price in March 2025 was $450,000, equal to the previous month and -17.81% lower than $547,500 from March 2024. The Days on Market (DOM) for March 2025 was 53 days, down -1.85% from 54 days from the previous month and equal to March 2024. The Months Supply of Inventory (MSI) is an indicator of a buyers’ vs a sellers’ market. Around 6 months is considered a balanced market. Less than 6 is typically a sellers’ market and more than 6 a buyers’ market. The March 2025 MSI of 6.83 months was at its highest level compared with March 2024 and 2023.Its proximity to Eglin Air Force Base makes it a popular choice for military families and personnel.

Crestview

Crestview is the leader in foreclosure activity, contributing the most to the county’s total. This city is becoming a hot spot for investors and first-time buyers, thanks to its affordability. While the properties may require some TLC, Crestview offers an entry point for those looking to break into the housing market or expand their real estate portfolio. Its location near Eglin Air Force Base also makes it a convenient and desirable area for military families. The median sales price in March 2025 was $321,355, up 1.20% from $317,550 from the previous month and 2.08% higher than $314,800 from March 2024. The Days on Market (DOM) for March 2025 was 109 days, down -9.92% from 121 days from the previous month and 49.32% higher than 73 days from March 2024. The March 2025 MSI of 5.28 months was at its highest level compared with March 2024 and 2023.

Fort Walton Beach

Fort Walton Beach boasts a competitive market with foreclosure properties priced between $203,300 and $224,900. The median sales price in March 2025 was $337,500, down -11.18% from $380,000 from the previous month and 5.47% higher than $320,000 from March 2024. The DOM for March 2025 was 90 days, down -12.62% from 103 days from the previous month and 57.89% higher than 57 days from March 2024. The March 2025 MSI of 7.67 months was at its highest level compared with March 2024 and 2023.

Destin

Ah, Destin—a favorite among vacationers and investors alike. Foreclosures are less common here, with properties starting at $275,000. The high demand for homes in this area keeps prices stable and the market competitive. If you’re eyeing a vacation property or an investment with long-term value, Destin should be on your radar. The median sales price in March 2025 was $665,000, up 18.33% from $562,000 from the previous month and equal to March 2024. The DOM for March 2025 was 123 days, up 2.50% from 120 days from the previous month and 28.12% higher than 96 days from March 2024. The March 2025 MSI of 11.26 months was at its highest level compared with March 2024 and 2023.

Final Thoughts

Okaloosa County’s housing market in 2025 is full of opportunities, whether you’re a buyer, seller, or investor. The current buyer’s market is a rare moment to find good deals, especially in areas like Crestview and Niceville.

If you’re curious about specific neighborhoods or want personalized advice, feel free to reach out. Let’s navigate this market together and find the perfect home or investment for you!

A Word of Caution: Purchasing Condos

If you’re considering purchasing a condominium, it’s important to be aware of the latest laws enacted after the tragic 2021 collapse of the Champlain Towers South in Surfside. Florida now requires milestone inspections for older buildings and structural integrity reserve studies to ensure funds are set aside for major repairs. While these measures are crucial for safety, they’ve led to increased costs for condo owners, including higher association fees and special assessments. Buyers should carefully review the financial health of the condo association and the results of any recent inspections before making a decision.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link