What coming to Niceville? – Let’s look at the Future. Recently in the Facebook group “Niceville Word of Mouth”, I posed the question, “If you could change one thing about Niceville, what would it be?” Over 300 people responded. Many asked for a downtown, more sit-down restaurants, more places for people to gather, more affordable housing, a sports complex, a Home Depot, a Target and many other similar responses. This morning, I had the opportunity to sit in on a discussion with David Deitch, City Manager of Niceville. He and his team have big plans and dreams for our sweet little town that I think will results in quite a few of these wishes.

What’s already in the works:

If you haven’t heard already, the city recently purchased and tore down an old building on Edge Ave. (click here for more details). This land along with the surrounding land that is owned by the city is slated for development. The plan is to provide more community gathering places. Hopes are for a walking area with shops and restaurants. Niceville is certainly lacking a true downtown.

Another project currently under development is a pier. Across the street from “The Blue-collar Cafe and what used to be the Front Porch, there is a small landing owned by the city. There are plans being developed to build a large pier with boat slips. Imagine being able to boat over and walk to the new downtown. Niceville has so many beautiful waterways and I think it would be great to show them off and make it easier for more residents to enjoy them.

The city is also working on making enhancements to our parks. The Children’s Park and the Rocky Runway Park are just 2 that are slated for updates. Some updates include making the facilities to cater to children with special needs. The Children’s Park is now open 7 days a week in case you didn’t know.

Reclaimed water to be used by the residents of Deer Moss Creek is coming close to fruition.

The city is also currently negotiating a 30-year lease for the Mullet Festival area. There are looking into redesigning the area to have dedicated sports fields for soccer, baseball, Lacross and Football.

Items a little farther in the future:

The city is also negotiating with Eglin Air Force Base to obtain several parcels of land. The hopes for this land will be for affordable housing for our local workforce. Currently a lot of our local workforce cannot afford to live in Niceville. This is an issue for teachers, firefighters, military, police officers, nurses, and many more. They are also hoping to develop a 55+ housing area on some of the land. Both of these items are sorely needed in Niceville!

Bringing more childcare facilities and more medical providers to Niceville is worked on.

Discussions are also being had about widening Rocky Bayou Dr, College Blvd and 285.

Another item that may be more of a dream is conversion to underground utilities.

How can you find out more and keep up on new developments?

If you want to know more about what’s coming to Niceville, there are several ways to do this. Midbay News is a great source of information. You can go to their website or sign up for their weekly email newsletter. You can visit the city’s website. For those of you who prefer Facebook – you can also follow the city and Midbay News on there. Of course, if you would like to hear it from the horse’s mouth, you can attend the city council or city planning meetings. You can also join the city manager and the mayor at their monthly “Coffee and Conversations”.

If you or someone you know is looking for a realtor that knows and loves Niceville, I am that person! Call Me!

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

Free boat with home purchase! It’s not often that you hear that. However, it is a real possibility. I am representing a homeowner who would like to sell their waterfront home and their boat. The house is located at 1716 19th Street in Niceville. The boat is a 30 ft 2006 Sea Ray 300 Sundancer. The boat is currently docked at the home on the 16K covered boat lift. Already have a boat, no worries. There are 2 additional boat slips. Interested in just the boat, it can be purchased separately and the current asking price is $49,750.

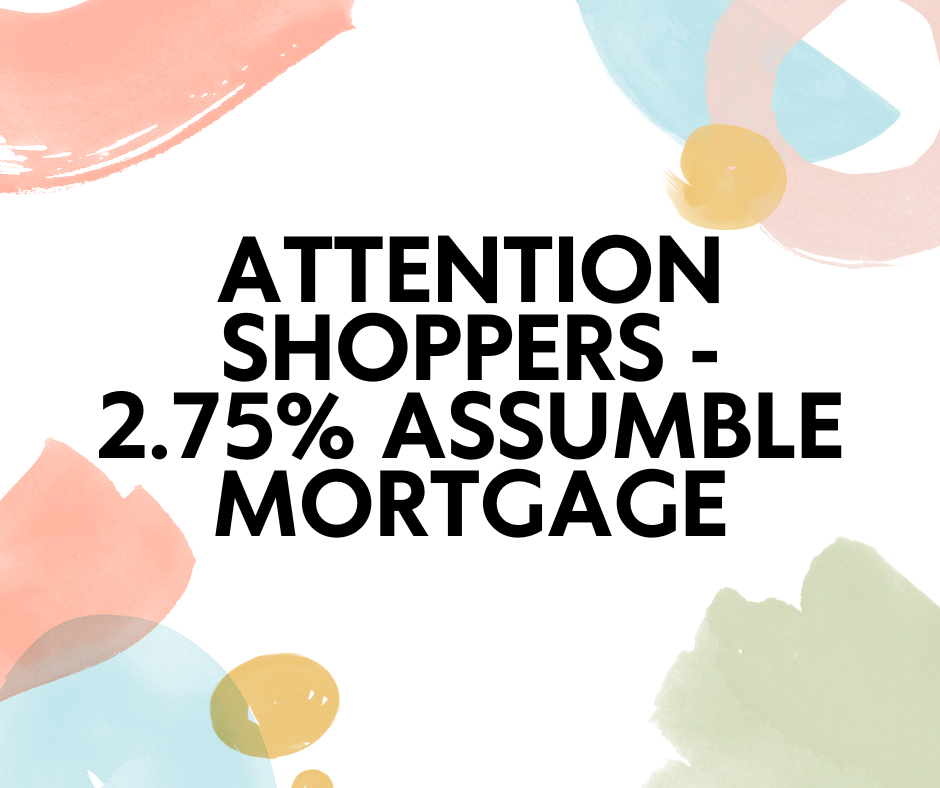

Free boat with home purchase! It’s not often that you hear that. However, it is a real possibility. I am representing a homeowner who would like to sell their waterfront home and their boat. The house is located at 1716 19th Street in Niceville. The boat is a 30 ft 2006 Sea Ray 300 Sundancer. The boat is currently docked at the home on the 16K covered boat lift. Already have a boat, no worries. There are 2 additional boat slips. Interested in just the boat, it can be purchased separately and the current asking price is $49,750. Interested in the house but not the boat, then the seller is ready to make other concessions. Perhaps you would like him to pay for your closing costs or buydown your interest rate or just accept a lower purchase price. Just give me a call (

Interested in the house but not the boat, then the seller is ready to make other concessions. Perhaps you would like him to pay for your closing costs or buydown your interest rate or just accept a lower purchase price. Just give me a call (

The house has been beautifully updated and is move in ready. The house is located on deep protected water in Sarah Ann Bayou. This bayou has direct access to the bay. I would love the opportunity to show you this lovely home. Just give me a call (

The house has been beautifully updated and is move in ready. The house is located on deep protected water in Sarah Ann Bayou. This bayou has direct access to the bay. I would love the opportunity to show you this lovely home. Just give me a call (