Congratulations, you just purchased a new home! Once you get unpacked and settled in, there are some important things you should know about your new home. Take some time to get acquainted with how your new property operates. The more you know, the less caught off guard you’ll be when problems arise and the faster you can return to the finer things in life.

- Water Shut Off Valve – In a plumbing emergency, you’ll want to know how to quickly find this valve and turn it off. Check for it in the garage or near your hot water tank. Often times in Florida, you will find it outside in the ground. It’s a good idea to turn this off when you are going to be away from your home for an extended period. It’s also a good idea to do so when fixing or replacing faucets or toilets.

- Electrical Panel – It’s good to know the location of this as well. Some homes have more than 1. If yours isn’t properly labelled, you will thank yourself later when you take the time to do so. If there were any electrical concerns brought up on your home inspection report (because you took the advice of a good realtor and had a home inspection done), have them evaluated by a licensed electrician.

- Gas Shut Off – If your home has natural gas, it’s important that you know where your main gas supply is located. In a single-family house, you can usually find it on the side or back of the house, just before the gas meter. Gas leaks can be dangerous and even fatal. Once you’ve turned off the valve, go outside call the gas company. Natural gas is naturally odorless, but there is an additive to give it smell for safety reasons.

- HVAC Filters – Replacing your HVAC filter on a regular basis is one of the best things you can do to keep it running efficiently. Find the location and size of all the intake filters and keep a supply of new ones on hand.

- Smoke Detectors – The National Fire Protection Association suggests placing a smoke alarm inside each bedroom, outside each sleeping area, and on each level of your home. If smoke alarms are already installed in your home, check their expiration dates and test them to confirm they are working properly. If they have batteries, replace them now and then again, a year from now. Not only will this help keep you and your family safe, but it will save you from the obnoxious beep at 3 a.m.

- Attic Access – Whether you want to examine its insulation, have a bunch of boxes that need a home, or are hearing strange animal sounds, it’s important to know where your attic is and what it has to offer. But before you start toting Christmas decor up there, verify that the floor is structurally sound, and the space is properly ventilated. To test the latter, touch your hand to the ceiling of a room below the attic on a hot day; if it’s warm, it may be a sign your attic is storing heat. Installing an attic fan may be a good idea to save you on your AC bill.

- Underground Lines – This is a big one in Florida. Before you dig, you will want to find out where your waterlines, sprinkler lines, cable line and more are located. You may be surprised to find out how close to the surface they are.

This is just a few of the important things you should know about your new home. If you took the advice of a great real estate agent, and had a home inspection done, the inspector probably included some great information in the report. I would go back and read it.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

Experienced realtors have in-depth knowledge of the local real estate market. They understand the unique characteristics of different neighborhoods, including historical trends and potential future developments that could impact property values.

Experienced realtors have in-depth knowledge of the local real estate market. They understand the unique characteristics of different neighborhoods, including historical trends and potential future developments that could impact property values.

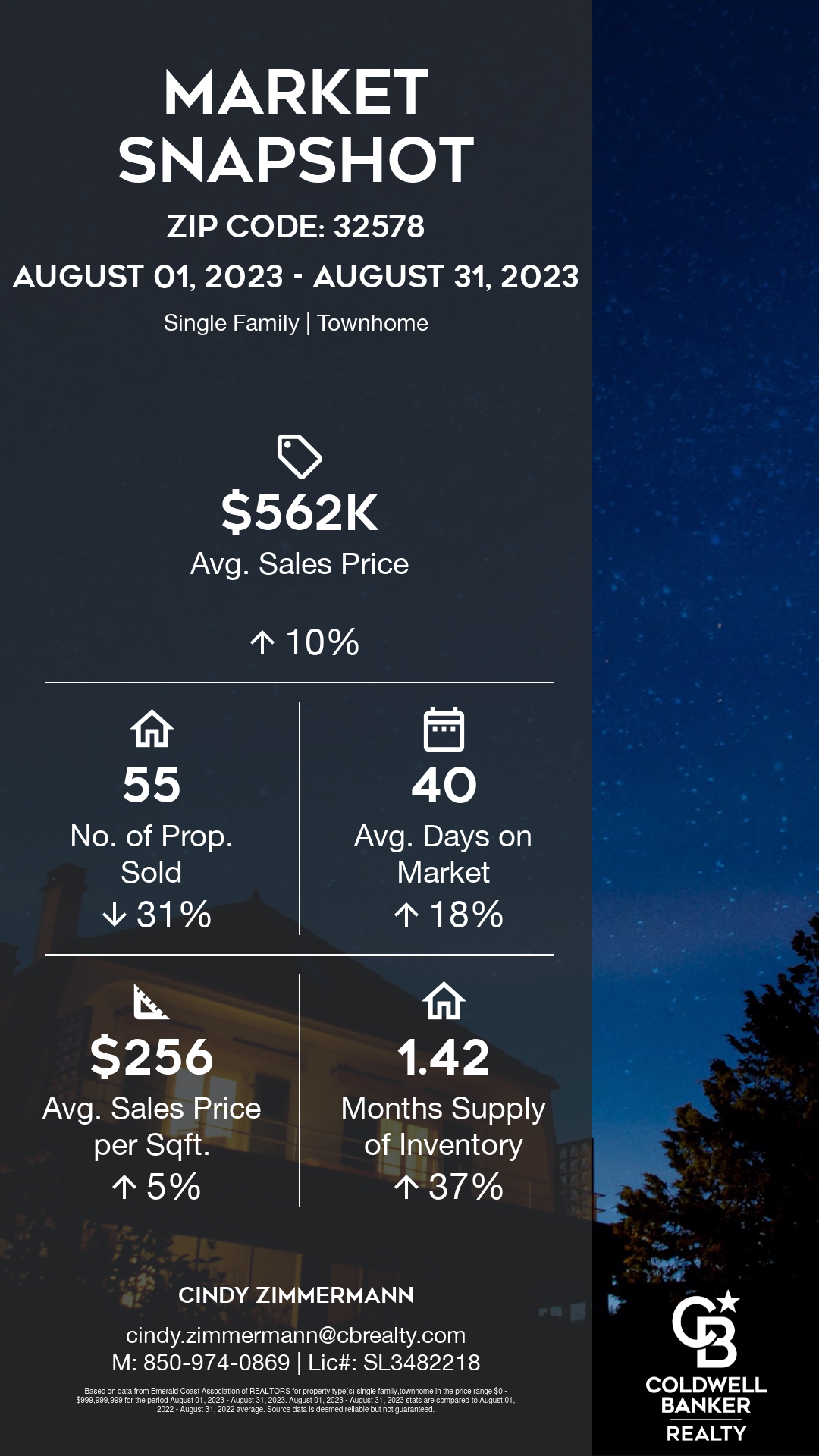

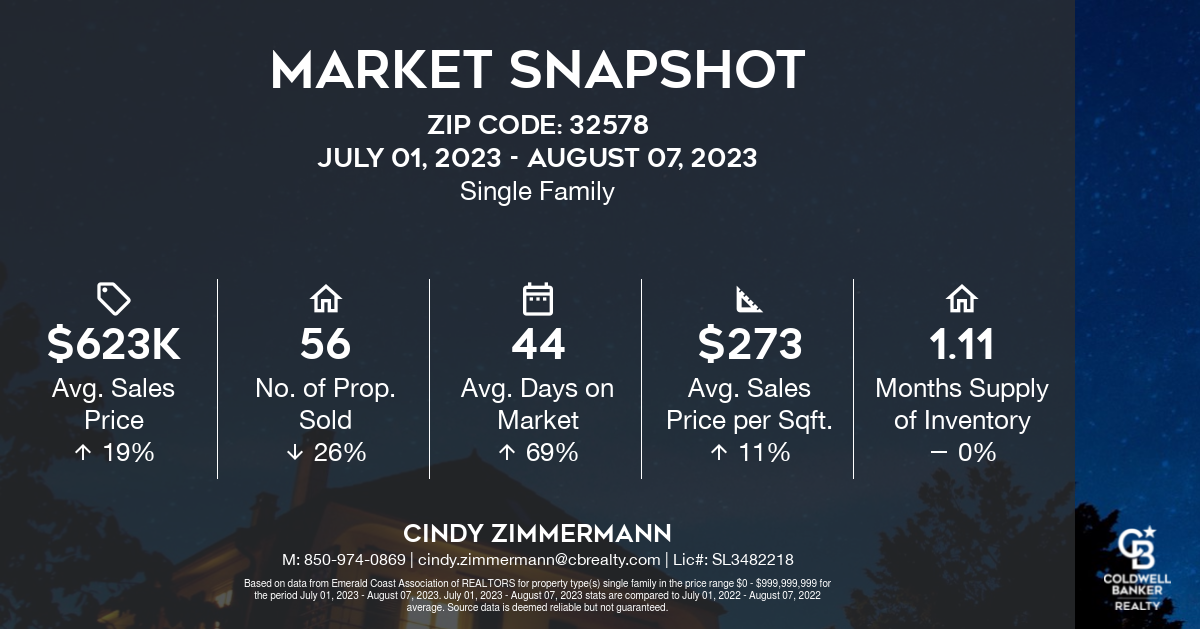

Real Estate Market Update for 32578 (Niceville). In the world of real estate, there are several important metrics that can provide valuable insights to both buyers and sellers. Today, we will explore these metrics to help you understand the current market conditions and make informed decisions.

Real Estate Market Update for 32578 (Niceville). In the world of real estate, there are several important metrics that can provide valuable insights to both buyers and sellers. Today, we will explore these metrics to help you understand the current market conditions and make informed decisions.

floor empty.

floor empty.

can’t see any items that may be store under the bed.

can’t see any items that may be store under the bed.